The Best Guide To Hsmb Advisory Llc

The Best Guide To Hsmb Advisory Llc

Blog Article

The Facts About Hsmb Advisory Llc Revealed

Table of ContentsThe smart Trick of Hsmb Advisory Llc That Nobody is Talking About4 Simple Techniques For Hsmb Advisory LlcHsmb Advisory Llc for DummiesThe Hsmb Advisory Llc PDFsOur Hsmb Advisory Llc PDFsUnknown Facts About Hsmb Advisory Llc

Ford claims to avoid "cash money value or long-term" life insurance coverage, which is even more of a financial investment than an insurance coverage. "Those are very complicated, included high commissions, and 9 out of 10 individuals do not need them. They're oversold because insurance coverage representatives make the largest compensations on these," he states.

Disability insurance can be costly. And for those who choose for long-term treatment insurance policy, this plan might make impairment insurance coverage unneeded.

The Facts About Hsmb Advisory Llc Uncovered

If you have a persistent wellness worry, this sort of insurance policy can end up being crucial (Health Insurance). Don't allow it stress you or your bank account early in lifeit's generally best to take out a plan in your 50s or 60s with the anticipation that you won't be using it till your 70s or later on.

If you're a small-business owner, consider protecting your source of income by buying organization insurance policy. In the event of a disaster-related closure or period of rebuilding, organization insurance policy can cover your revenue loss. Take into consideration if a significant climate occasion influenced your storefront or manufacturing facilityhow would that influence your earnings?

Plus, using insurance coverage could sometimes cost even more than it saves in the lengthy run. If you get a chip in your windshield, you might think about covering the repair work cost with your emergency situation savings instead of your vehicle insurance coverage. Life Insurance.

The Best Guide To Hsmb Advisory Llc

Share these tips to safeguard loved ones from being both underinsured and overinsuredand speak with a relied on specialist when required. (https://anotepad.com/note/read/4pb35s8c)

Insurance coverage that is bought by an individual for single-person coverage or insurance coverage of a family. The individual pays the premium, as opposed to employer-based health and wellness insurance where the employer commonly pays a share of the costs. Individuals might buy and acquisition insurance coverage from any kind of plans readily available in the person's geographic region.

Individuals and families might qualify for financial help to decrease the price of insurance costs and out-of-pocket expenses, however only when registering through Attach for Health And Wellness Colorado. If you experience certain changes in your life,, you are eligible for a 60-day duration of time where you can register in a specific strategy, even if it is outside of the yearly open registration period of Nov.

15.

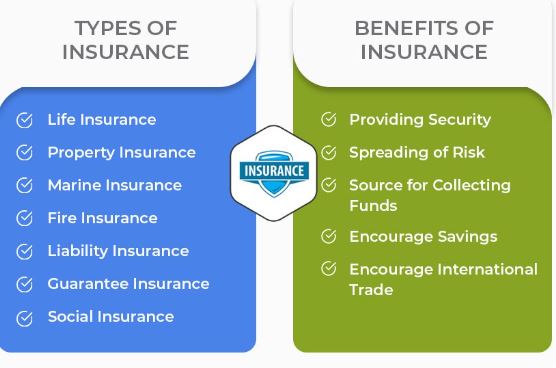

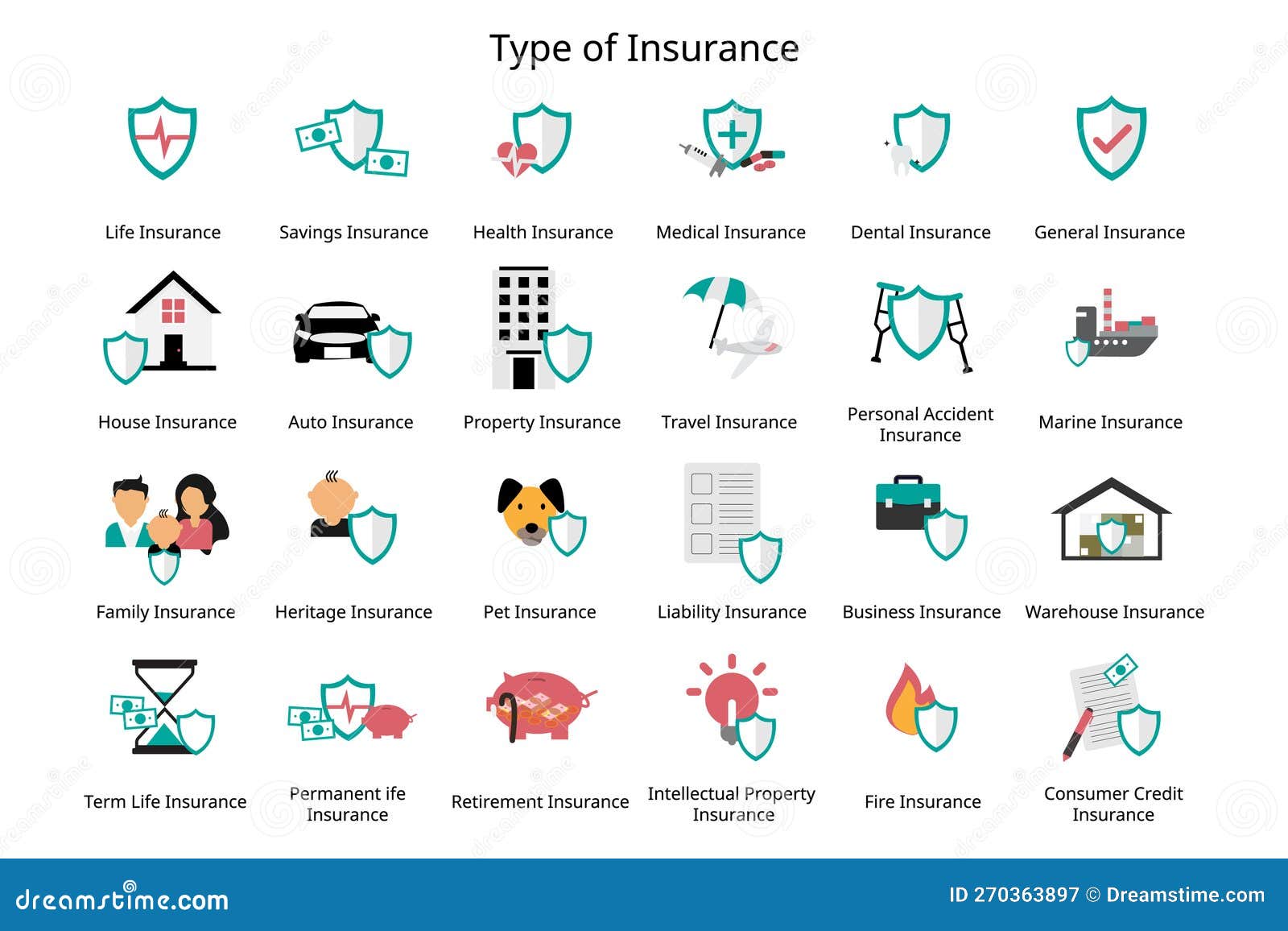

It might appear simple but comprehending insurance policy types can also be confusing. Much of this confusion comes from the insurance coverage industry's recurring goal to develop customized insurance coverage for policyholders. In making flexible policies, there are a variety to choose fromand every one of those insurance policy kinds can make it tough to comprehend what a specific plan is and does.

Get This Report on Hsmb Advisory Llc

The finest place to start is to speak about the distinction between both kinds of fundamental life insurance: term life insurance policy and long-term life insurance. Term life insurance is life insurance that is only active for a time duration. If you die throughout this duration, the person or individuals you have actually named as recipients might get the cash money payout of the plan.

Nonetheless, lots of term life insurance coverage policies allow you convert them to an entire life insurance policy policy, so you don't lose coverage. Normally, term life insurance policy plan premium repayments (what you pay per month or year into your policy) are not locked in at the time of purchase, so every 5 or 10 years you own the plan, your premiums can increase.

They also have a tendency to be less expensive overall than whole life, unless you buy an entire life insurance coverage policy when you're young. There are also a few variations on term life insurance policy. One, called team term life insurance policy, is common among insurance policy alternatives you might have accessibility to through your company.

Hsmb Advisory Llc Things To Know Before You Buy

This is typically done at no charge to the staff read this post here member, with the capability to acquire additional protection that's gotten of the worker's income. One more variant that you could have access to with your employer is supplemental life insurance policy (Insurance Advise). Supplemental life insurance policy might include unintended death and dismemberment (AD&D) insurance, or burial insuranceadditional insurance coverage that could aid your household in case something unexpected takes place to you.

Irreversible life insurance policy merely refers to any kind of life insurance plan that doesn't end. There are numerous sorts of long-term life insurancethe most typical kinds being whole life insurance policy and global life insurance policy. Entire life insurance policy is specifically what it seems like: life insurance for your entire life that pays to your beneficiaries when you die.

Report this page